Financials are Healthy? There are two main aspects of a financially healthy company. To judge a company’s profitability levels, the use of financial ratios is essential. Business is Profitable? As an investor, it is important to invest only in those companies which are sufficiently profitable. But what is the expected end results? The analyst expects to get an answer for the following questions as a result of stock analysis: Expected answers from stock analysis: In the process of stock analysis, we study the reports and price data of stock. Hence, while analysing stocks in Excel we must use at least 10 year reports. To analyze a stock in a more reliable way study of only one year report will not be enough. The fifth (5) report is the historical price data of the stock. They can be four types of financial reports: (1) balance sheet, (2) profit and loss account, (3) cash flow statement, and (4) quarterly reports. What is Stock Analysis?Īs you can see in the above infographics, stock analysis basically deals with financial reports and price data of a stock/company. A good starting point for newbies will be to learn about the financial ratios used in stock analysis.

This know-how will build a perspective on the subject, and would eventually chalk the path for more effective Excel usage. It is a great application.īut before people can take a plunge into Excel and start doing analysis on their own, it is better to take a step back and understand what actually is stock analysis. In this regard, its capabilities are nearly endless.

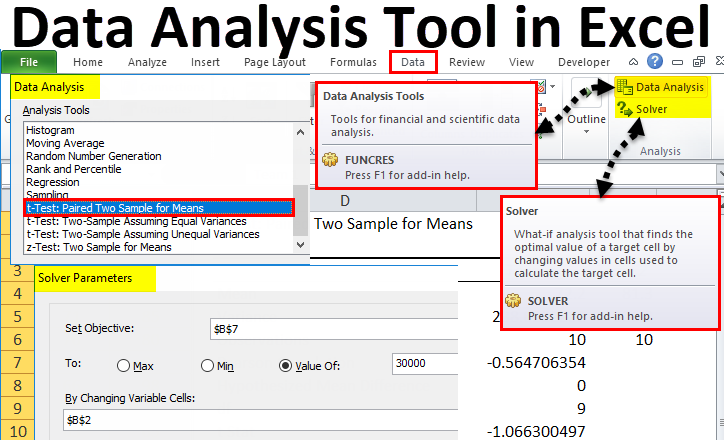

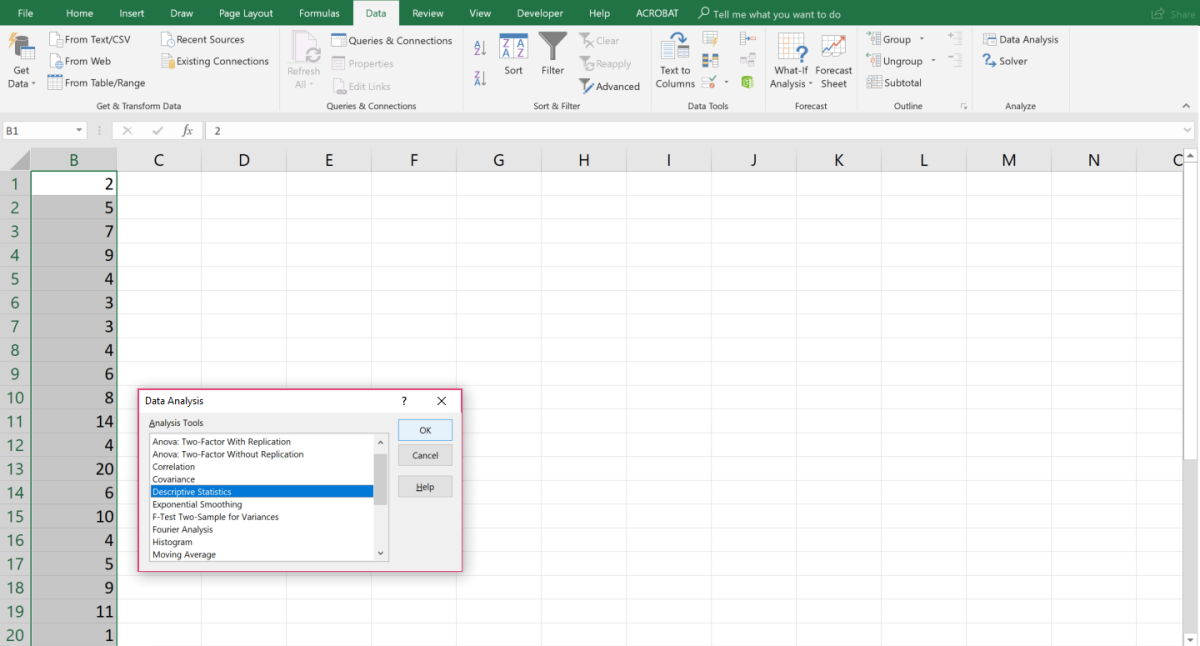

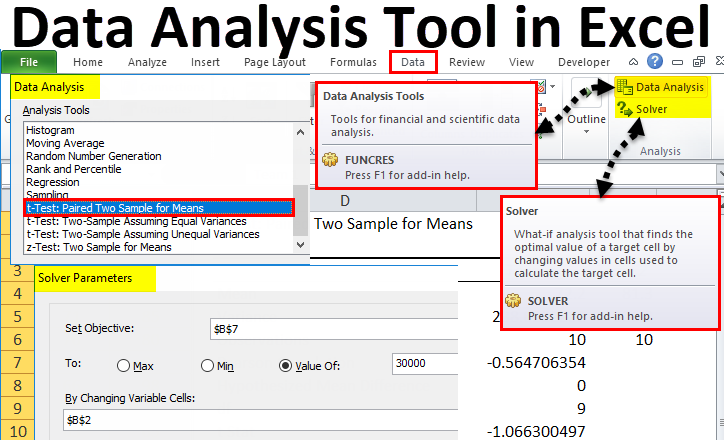

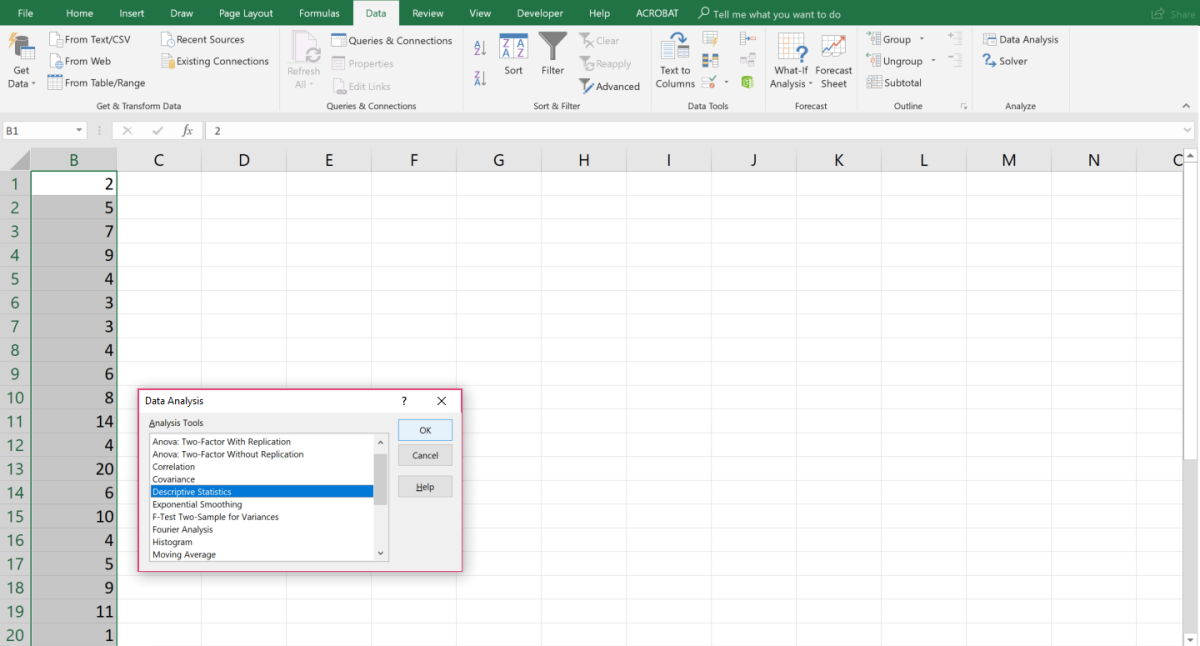

#GET DATA ANALYSIS EXCEL HOW TO#

So in a way, we can say that stock analysis in Excel can be done virtually for free.īut how to analyze stocks in Excel? What needs to be done? This is where Excel can carve a niche for itself as a stock analysis tool. Generally, when we buy laptops/computers, our device is preloaded with MS Office which has Excel. So what is the solution? We can analyze stocks in Excel. Why? Because of the lack of suitable tools. They would do stock analysis before investing.

Given a chance, an informed investor would not buy-sell stocks blindly.

0 kommentar(er)

0 kommentar(er)